U.S. stock markets have been volatile for the last few weeks. Just look at the holiday charts below!

Depending on which stocks you hold, you may have sustained big losses (or you may have actually profited from the turbulence).

As traders get set to close up shop early for the holiday season, it’s important to know where things stand.

It’s also time to set your investing plan for 2022!

Today I wanted to spend some time looking at a few of the most important holiday charts in today’s market. This way, you’re up to date on current market trends and ready to kick off a profitable new year.

The Bull Market is Still Intact

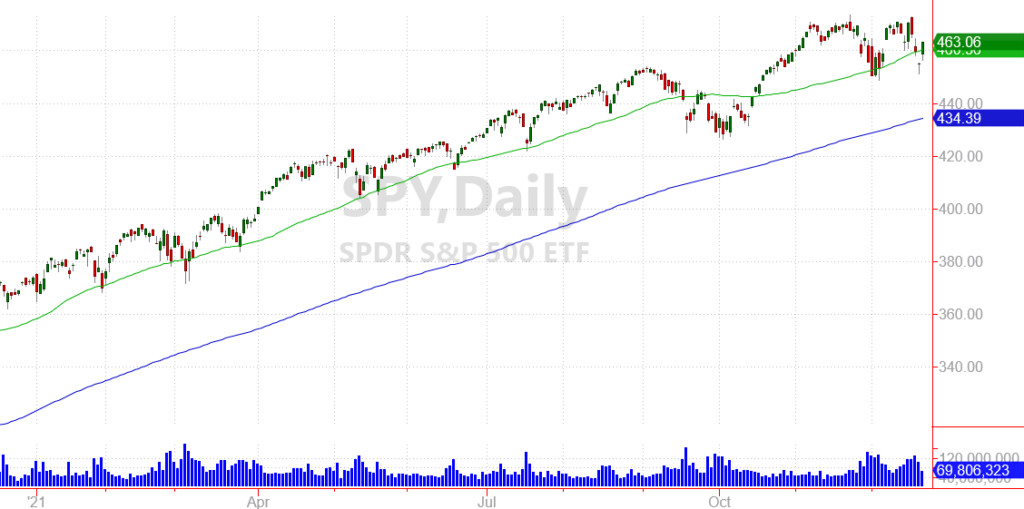

The overall bull market for blue chip indexes like the S&P 500 and Nasdaq 100 is still very much intact.

Major averages pulled back to key support levels (twice) over the past few weeks. But so far, investors continue to “buy the dip” and plow money back into the largest stocks that drive these key indices.

For the S&P 500 index, the 50-day moving average (green line) continues to be a key area where buyers are willing to step in and buy. Tuesday’s sharp rebound shows that there’s still a lot of confidence in the market despite challenges from the Omicron variant.

The Nasdaq 100 index tells a similar story. This index features 100 of the largest non-financial stocks in the Nasdaq composite. It’s heavily influenced by the largest tech stocks in the market.

This index has also tended to find support at (or just below) the 50-day moving average over the past year. Keep in mind, there’s nothing “magical” about this line. But traders looking at holiday charts this week will notice that other investors have been buying at this level. That buying pressure naturally leads to higher prices as stocks respond to more demand.

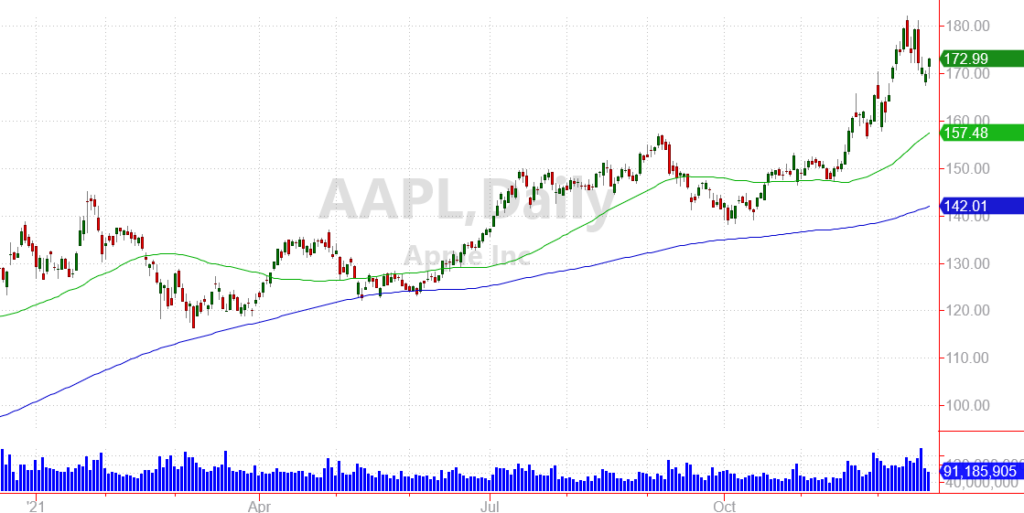

One reason these blue-chip indices have been able to keep moving higher is the strength in shares of Apple Inc. (AAPL). Since AAPL shares are worth nearly $3 trillion, this one stock has a big influence on large-cap indices like the S&P 500 and Nasdaq 100.

So as long as AAPL continues higher, we should see “the market” move higher as well. That makes AAPL an important stock to watch. And it’s also a good reminder that when you look at “the market” it doesn’t necessarily represent the way most stocks are trading.

Now, let’s look at some of the individual areas within the market to see what risks and opportunities are out there!

Speculative Stocks are Out — Reliable Stocks are In!

There’s a big market shift going on right now. For the last few months, investors have been moving money out of stocks with big growth prospects (and small or negative earnings today).

Instead, investors have been opting for stocks of companies that make money now.

This shift led to big gains for certain areas of the market, and big losses for some of the most popular growth stocks. There could be a lot farther to go before this trend is over.

The ARK Innovation Fund (ARKK) gives us a perfect holiday charts snapshot of how this trend is playing out. This fund is filled with many of the most exciting (and speculative) stocks in the market today. And as you can see, the overall trend has been down.

After the fund’s most recent breakdown, ARKK may be due for a short-term bounce. But most of the stocks held in ARKK are still very expensive, so there’s plenty of room for this trend to continue.

But that doesn’t mean you need to abandon investing in technology altogether. There are still some wonderful opportunities to profit from technology stocks.

The chart above covers the Semiconductor Index. Strong demand for computer chips continues to drive profits for semiconductor companies. And many stocks in this area continue to hit new all-time highs.

I’m holding a few large positions in semiconductor stocks, and expect more profits to come. I would be happy to put more money to work in this area, (especially buying on a short-term pullback). But I would focus on companies that are already profitable. This is a more challenging period for up-and-coming semiconductor stocks that don’t yet have positive earnings.

Key Factors to Watch in 2022

Looking out toward next year, there are a few important holiday charts you need to keep a close eye on.

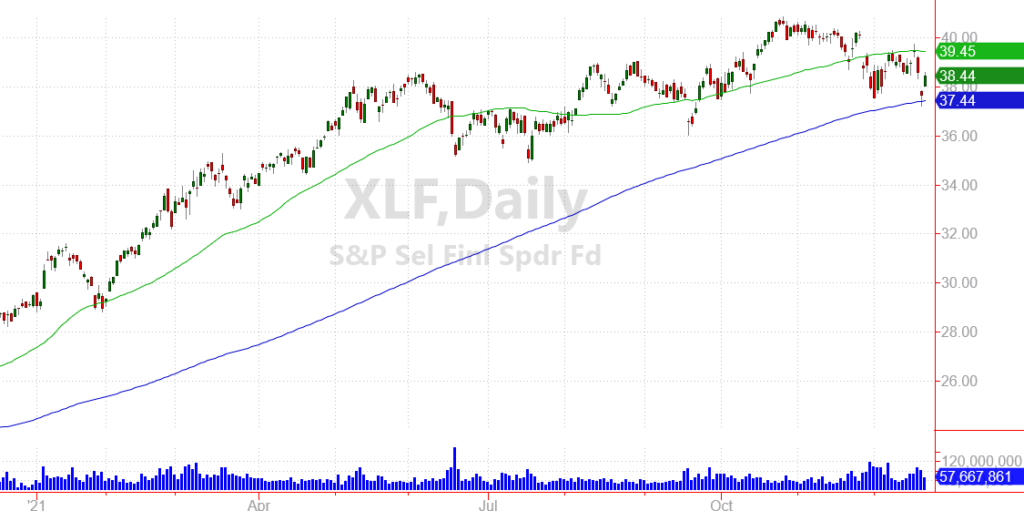

First, let’s look at financial stocks:

Financial stocks have been on my buy list for a while now, thanks to two key profit drivers.

First, higher interest rates help banks generate more profits on loans. As the Fed shifts policy and starts working to fight inflation, interest rates are almost guaranteed to move higher. That may be bad news for other areas of the market, but it’s good news for financial stocks.

Second, the overall economy is in an expansion period, and businesses need access to capital. This gives banks the chance to issue new loans, underwrite securities, and help corporate customers in other ways too. The year ahead is shaping up to be a good one for financial stocks.

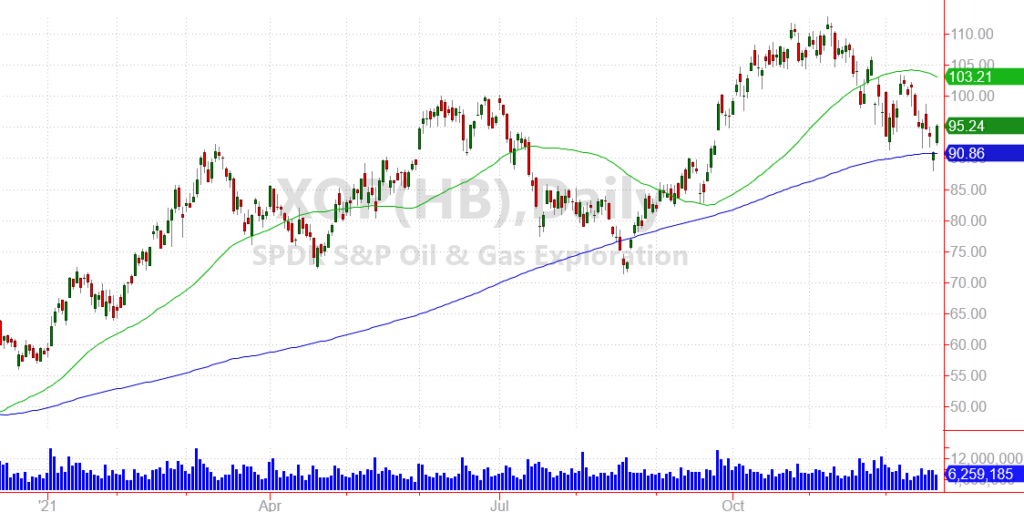

I’m also keeping a close eye on the price of oil and the performance of energy stocks.

Omicron concerns helped to drive oil prices lower in recent weeks. But the overall global expansion should be a tailwind for oil prices in the year ahead.

This bodes well for energy stocks. The Oil and Gas Exploration Fund (XOP) is a good barometer for oil stocks, and the group appears to have found support at the 200-day average (blue line).

Again, there’s nothing magical about this line. But if investors decide to buy at this level, it can lead to more confidence, more buying and higher prices ahead.

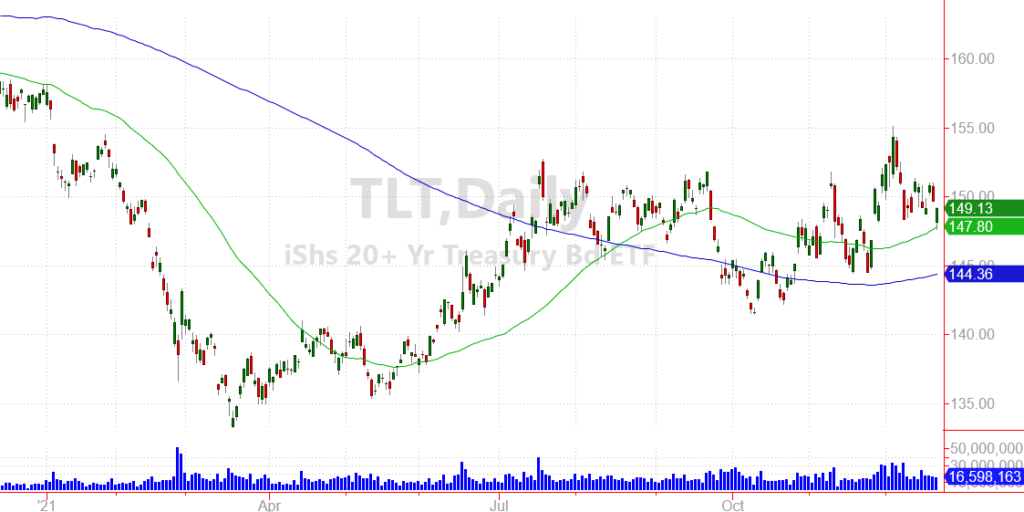

Finally, let’s take a look at long-term treasury bonds:

Treasury bonds trade in the opposite direction from interest rates. So as rates rise in the year ahead, we should see bond prices trade lower.

The iShares 20+ year Treasury Bond ETF (TLT) gives you a quick snapshot of how bonds are trading. And I expect to see this fund trend lower (possibly sharply lower) in the year ahead. Keep a close eye on this ticker to get a better feel for interest rates. And remember, these rates affect everything from the price of funding for new projects, to the investment and savings alternatives available in today’s market.

Happy Holidays from the Scheidt Family!

I wanted to take a quick moment to wish you and your family a happy, healthy and safe holiday season!

Hopefully you’re able to spend some time with the ones you love and enjoy a bit of downtime during this special season.

I can’t tell you how excited I am about the year ahead. Hopefully we’ll be able to work together to grow your family’s wealth so you can continue to focus on the things that really matter.

Here’s to growing and protecting your wealth!