Another window of opportunity is opening for income investors!

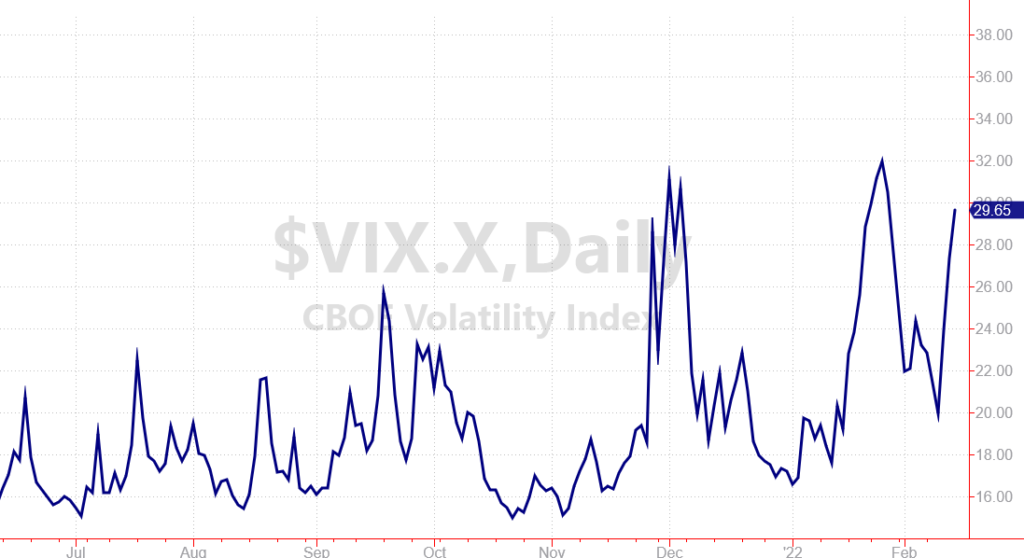

Remember Wall Street’s “fear index” we talked about last month?

The indicator looks at the level of uncertainty in the stock market, and tells us how much investors are willing to pay for “insurance” contracts to protect their portfolios.

Last month, the index spiked as tech stocks sold off. And this week, we’re seeing another sharp increase for the CBOE Volatility Index (VIX).

So what does that mean for your investments?

A spike in the VIX can mean bigger income payments for investors who sell these insurance contracts to lock in payments.

This “put-selling” strategy allows you to collect an instant income payment in exchange for promise. (When you sell a put contract, you’re entering a limited-time agreement to buy shares of stock at a certain price.)

This strategy is at the heart of my favorite income strategy — one that has helped me to collect payments from stocks like Bed Bath & Beyond (BBBY), HP Inc. (HPQ), Royal Caribbean Cruises (RCL) and more!

Now that the VIX is spiking again, investors can sell these contracts for higher prices, collecting more income in the process. The strategy is a great way to help offset some of the risk in today’s market, and collect more income from some of your favorite stocks.

So far in 2022, we’ve seen a lot of turbulence for stock prices. Strategies that worked well last year just aren’t producing the same returns so far this year.

I’m grateful to be able to take a different approach to the market. And I’d love to help you learn how to use this alternative strategy in your own portfolio.

If you’d like to see this strategy in action today, check out my Accelerated Income Trading Service.

Now, let’s shift gears and take a look at some of the most important news I’m watching as we kick off a new week of trading.

Inflation Fears Rattle Investors’ Nerves

- Bloomberg: Fed’s Bullard basks supersized hike.

- Bullard said he supports raising rates by full percentage point.

- He said he was undecided on a 50 basis point hike in March.

- Comments came after January CPI showed 7.5% annual inflation.

- Bloomberg: Inflation hot spots: prices surge 9% in mountain states.

- Prices rose 9% (annualized) in mountain state region last month.

- States include Arizona, Colorado and Idaho.

- U.S. Cities with high inflation: Tampa (9.6%) & Denver (8%).

- Bloomberg: Aluminum stockpiles to disappear by 2024?

- Trafigura Group warned that aluminum inventories could disappear.

- Aluminum is used in packaging, manufacturing and more.

- Spot prices surged to an all-time high this year.

Managing Your Income & Investments

- CNBC: 4 ways to make sure your retirement savings last.

- Unknown factors such as healthcare costs can cause problems.

- Adjusting spending based on investment performance can help.

- Use a “ceiling and a floor” to bracket spending decisions.

- Bloomberg: Treasuries haven’t started this badly in 4 decades.

- 2022 is starting to be a grim year for fixed income investors.

- Fixed income (bonds) is a pain trade that won’t end soon.

- As interest rates rise, bond prices will continue to fall.

- Bloomberg: Expedia swings to profit despite omicron setbacks.

- The holiday travel season proved resilient despite omicron.

- Management expects continued travel recovery.

- Bookings were $17.5 billion during the fourth quarter.

Digital Versus Tangible Goods

- CoinDesk: Crypto markets really are thinner now.

- Trading volumes as a percent of market cap are lower.

- This means it takes less capital to move prices higher or lower.

- McKinsey & Co: We’re gonna need a bigger shovel.

- Transition to a net-zero carbon economy will be metal intensive.

- Demand for base metals (copper and nickel) is soaring

- Rarer metals like lithium and cobalt are critical.

The Political Landscape & Your Wealth

- Reuters: Russia’s Lavrov proposes diplomatic work.

- Russian foreign minister suggested diplomacy for now.

- Lavrov said the U.S. put forward proposals on reducing risks.

- However, responses from EU and NATO “had not been satisfactory.”

- CNBC: Ukrainians feel they’ve been abandoned.

- Airlines are cancelling flights, investors are withdrawing capital.

- Diplomats are leaving the country ahead of a likely invasion.

- Ukraine is seeking agreements for more international support.

- WSJ: Why Russian invasion peril is driving oil prices near $100.

- Demand for oil has already outpaced production.

- A military conflict with Russia would likely reduce supplies further.

- Expect volatility for oil prices in the weeks and months ahead.

- Bloomberg: The U.S. is exporting every molecule of LNG possible.

- Tankers were docked or loading at all 7 U.S. LNG export terminals.

- Demand from LNG terminals set a record of 13.3bcf of nat gas flows.

- Export terminals will be able to draw as much as $13.9bcf.