This week, I had a long conversation with an old investment friend about gold.

It may sound like a boring conversation given the hot issues in the market and around the world right now.

But as Dan and I talked about economics, politics, technology and more; I knew that I needed to share what we talked about with you today.

If you have worked hard to set aside savings for your family, you need those savings to be worth something in the future. That’s why you should at least consider some gold and silver investments to protect your wealth.

Here are three big reasons to invest in gold today — before prices move any higher.

Invest in Gold to Protect Against Inflation

For thousands of years, gold has given investors protection from rising prices.

The rule of thumb is that an ounce of gold should be able to buy a high-quality men’s suit. So as prices for the goods we buy rise (in dollars), gold’s value is supposed to preserve your spending power.

(I’m too cheap to spend $2k on a single suit. But I know a few people who consider this a “reasonable” price. So the gold / suit ratio appears to be holding up.)

Inflation is hitting the highest levels in decades. And that means the value of cash is steadily declining.

As an investor — or as a saver or even just a consumer — it’s becoming more important to offset the damage inflation is causing.

The best way to protect your wealth against inflation is to own investments that increase in value as inflation rises. Gold, silver and other precious metals have held their value for generations — and look like good investments right now as well.

Russia’s War Adds to Gold’s Attractiveness

Russia’s invasion of Ukraine has added another interesting variable for precious metals.

As refugees flee the country, many Ukrainians are trying to figure out how to also move their family savings out of the country.

Meanwhile, global sanctions on Russia and related oligarchs has highlighted the need for some to move wealth out of traditional financial markets and into more portable (and durable) stores of wealth.

Now the world has little sympathy for these bad actors and the hoops they need to jump through to protect their wealth.

But the situation does draw attention to how political and financial powers can freeze traditional means of wealth.

In short, geopolitical uncertainty is driving global demand for precious metals. And as buyers accumulate gold and silver to protect the value (and portability) of wealth, precious metal prices should continue to rise.

The Technical Picture Also Favors Gold

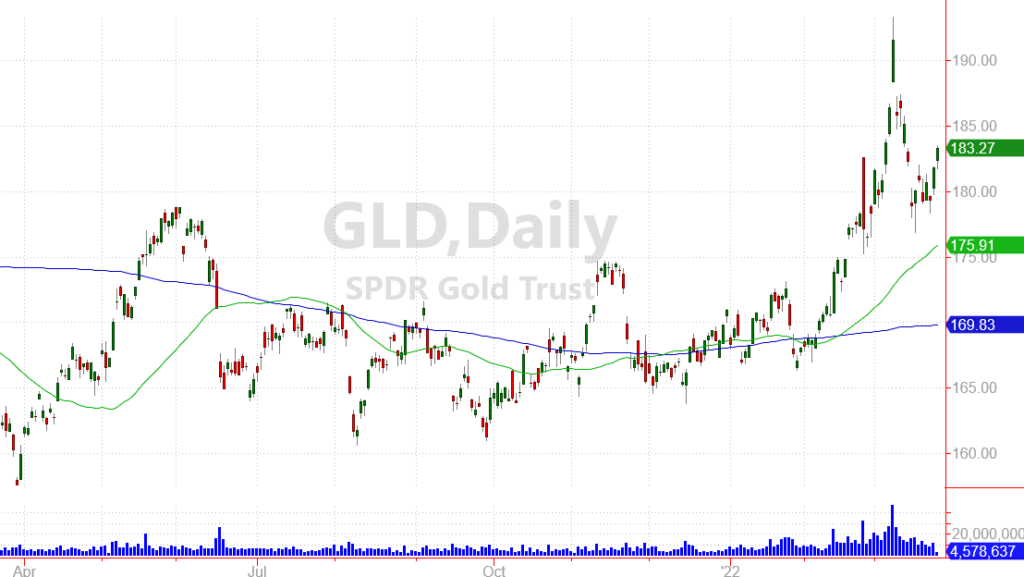

Gold’s price action is another great reason to invest in precious metals today.

Earlier this year, we looked at Gold’s multi-month consolidation, noting that it was a good time to invest in gold.

Following that alert, gold moved sharply higher throughout February and into early March.

More recently, gold pulled back to test the breakout point before finding support last week.

The surge for precious metals so far this year shows how quickly momentum can pick up for this area. And the recent pullback gives investors what could be one last chance to invest before gold pushes to all-time highs (and likely continues to run from there).

While there is nothing “magical” about a price chart, these tools can give us helpful information about buyers and sellers, and give us an idea of how motivated individual traders are becoming as they build positions in gold.

Today, the fundamentals, current events, and technical patterns all point to higher prices for gold. And with all three of these factors trending positive, I’m a big fan of investing in gold to protect and grow your wealth.

In my next alert, I’ll cover a few ideas for how to invest in gold. That way you can make the most of this high-powered trend.

For now, let’s switch gears and take a look at some of the most important research items on my desk right now.

Stock-Moving Headlines

- Factset: Second highest number of “supply chain” mentions.

- 358 S&P 500 companies cited supply chain issues during earnings call.

- Industrial and tech companies had the highest number of instances.

- Consumer Staples and Materials had highest percentage of citings.

- CNBC: Olive Garden parent’s earnings miss estimates.

- Darden Restaurant (DRI) earnings and revenue missed investor estimates.

- Management lowered the company’s earnings outlook for fiscal 2022.

- Omicron disrupted customer traffic, staffing and expenses.

- CNBC: Google will allow Spotify to offer own billing.

- The Spotify app will allow android users to pay directly through Spotify.

- This decision puts pressure on Apple, which bans third-party billing.

- SPOT is set to trade higher Thursday morning.

- Barron’s: KB Home falls as supply chain issues delay deliveries.

- KBH first quarter results missed analyst estimates.

- Supply chain issues intensified during the quarter, extending build times.

- The average selling price for Q1 rose 22% to $486,100.

Russia’s Effect on Energy Continues

- FT: Russia chokes major oil pipeline in further threat to global supplies.

- Russia cut supplies to major pipeline that sends oil to global markets.

- Repairs to the Caspian Pipeline could shut it down for two months.

- International oil prices rose to as high as $117 per barrel.

- Reuters: Putin wants to get paid for Russian gas in roubles.

- “Unfriendly” countries will be required to pay for natural gas in roubles.

- The move seeks to shore up the value of the ruble which has fallen.

- Russian gas accounts for 40% of Europe’s total consumption.

- Bloomberg: Energy stocks are now negatively correlated to markets.

- The correlation between energy stocks and the market turned negative.

- This is the first time this has happened in more than 20 years.

Inflation, Interest Rates and Crypto

- WSJ: Gas prices shoot up at fastest rate on record.

- Average prices for gasoline have been at record highs for 2 weeks.

- Adjusted for inflation, gas prices aren’t quite as high.

- Drivers still face the biggest monthly increase since the 1970’s.

- Bloomberg: Possible need for half-point Fed rate hike.

- Fed president Mary Daly says possible 50 bp hike at next meeting.

- A decision to shrink the Fed’s balance sheet could also occur.

- “Prepared to do whatever it takes” to fight inflation.

- CoinDesk: Ether options shed bearish skew for first time in 2 months.

- Investors buying fewer put contracts for ether.

- This means there is less demand for downside protection.

- CNBC: Russia-Ukraine war could accelerate use of cryptocurrencies.

- BlackRock’s annual letter from CEO Larry Fink covered digital assets.

- Crypto adoption is one of the “less discussed” outcomes of the war.

- Digital currencies can bring down costs of cross-border payments.