As the stock market makes another move lower, investors are becoming more concerned.

Many of these investors have been doing something to protect their wealth — buying what some call “stock insurance” to offset losses.

Today, I want to show you how these “insurance policies” work.

You may be tempted to buy some of this insurance for your own investment account. But I’m hoping you’ll at least consider selling some policies to collect up-font payments — just like an insurance company would do.

After all, the fear in today’s market has caused the price for stock insurance to rise. And that means there’s more money to be collected from some of these lucrative policies.

What IS Stock Insurance?

The insurance policies that I’m talking about are known as “put contracts” on Wall Street.

These securities are basically contracts — or agreements — between two traders.

If you buy a put contract, you have the right to sell (or “put”) stock to another trader at a pre-determined price. For example, you might buy a put contract that gives you the right to sell shares of Apple Inc. (AAPL) at $150 per share.

On Friday, shares of AAPL closed at $161.79. So you wouldn’t want to sell AAPL at $150 right now.

But what if the recent stock market weakness were to spread — and shares of AAPL dropped to $120?

If that happened, you’d be pretty happy to have the right to sell your shares at $150.

And that’s exactly how these put contracts work. Buyers of these contracts have “insurance” that allows them to sell shares at a specific price — no matter how low the underlying stock trades.

Each contract is valid for a limited amount of time. And you can buy a contract that expires this week, next month, or even a few years from now!

In a turbulent market like we have right now, I’m sure you can see how this type of insurance policy is becoming more appealing to investors.

But before you go out and start buying put contracts for stocks in your account, let’s look at a few more details…

The Price of Insurance is Rising

Let’s think about a traditional homeowners insurance policy for a second…

If you own a house near downtown New Orleans, it’s a good idea to have flood insurance. It’s also pretty pricey to buy one of these policies.

After all, one day a storm will roll in and it’s almost certain that your home will have some flood damage.

So the more risk of a big problem, the more you’ll have to pay for an insurance policy.

The same is true for the put contracts investors use for stock insurance.

As the market becomes more turbulent and stock prices fall, insurance is becoming more expensive.

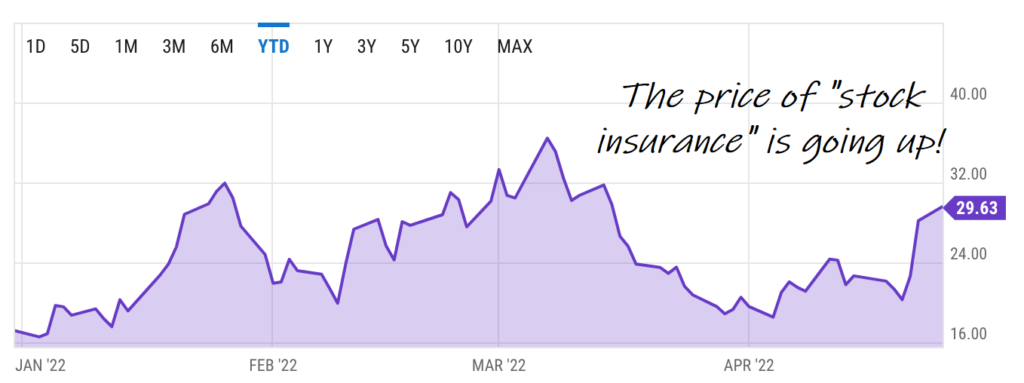

The chart below measures how much investors are paying to insure a basket of stocks in the S&P 500. (This index is called the CBOE Volatility Index — known as the “VIX”)

The good news for you is that there’s actually a way to profit from the higher insurance costs. Because you can actually sell Wall

Street’s insurance policies (or put contracts) much the way an insurance company would do.

Selling Stock Insurance as Others Panic

One of the things I love about free markets is that there are two sides to every trade. And on Wall Street, you can be on either side of this stock insurance trade.

You can choose to buy insurance for investments that you own.

OR…

You can sell a put option contract to effectively sell insurance on individual stocks.

And the best part is that you can sell these put contracts on your favorite stocks. The ones that you have the most confidence in and would be happy to buy.

For example, take one of my favorite stocks in the energy market right now: Schlumberger Ltd. (SLB).

The company helps oil and natural gas drillers with equipment, technology and manpower. And now that oil prices are high and drillers need more support, SLB’s business is picking up.

On Friday, SLB closed near $41.65.

At the same time, you could have sold a May $40 put contract for more than $1.50 per share.

If you sell one contract, you’re agreeing to buy 100 shares of SLB at $40 — below the stock’s current price. You’re also receiving $1.50 (or more) per share to make that promise. And your obligation only lasts until the market close on May 20th.

Each contract represents 100 shares. So if you sell one of these contracts (and agree to buy 100 shares of SLB), you could have instantly collected $150 for “insuring” shares of SLB.

Picking Out the Best Stocks to Insure

Whenever I sell stock insurance (or put contracts) to collect income for my own account, I pick stocks that I would like to own. I also choose an agreement price that I’m happy to pay for my shares.

In today’s market, I prefer companies that generate real (reliable) profits, companies that have access to tangible resources, and stocks that trade at relatively low prices compared to earnings.

These stocks have generally been more stable than some of the more risky plays. And this can help our insurance strategy by making it less likely the stocks will pull back below our agreement price.

We may not receive quite as much income selling “insurance policies” against stable stocks. But the idea is to sell put contracts with less risk.

Plus, now that the market is more volatile, other traders are willing to pay up for these insurance policies. So even put contracts for stocks that are more stable still offer great up-front payments.

Given the higher price of stock insurance (or put contracts) in today’s market, now is a great time to start learning this alternative investment strategy.

~~~~~

Editor’s Note: If you would like to see a live portfolio of these insurance policies in play, be sure to check out my put-selling model portfolio.

For just $99 per month, you can get real-time alerts any time I sell a new put contract or “stock insurance” policy. You can then decide if you want to sell the same insurance policy in your own account.

There’s a 30-day money back guarantee. So feel free to check it out just to learn how the strategy works!

~~~~~

Here’s to growing and protecting your wealth!

Zach