With the recent selling in the stock market, it’s tempting for many investors to get frustrated and throw in the towel.

But just like many other areas of life, things are often the most frustrating just before real improvement happens.

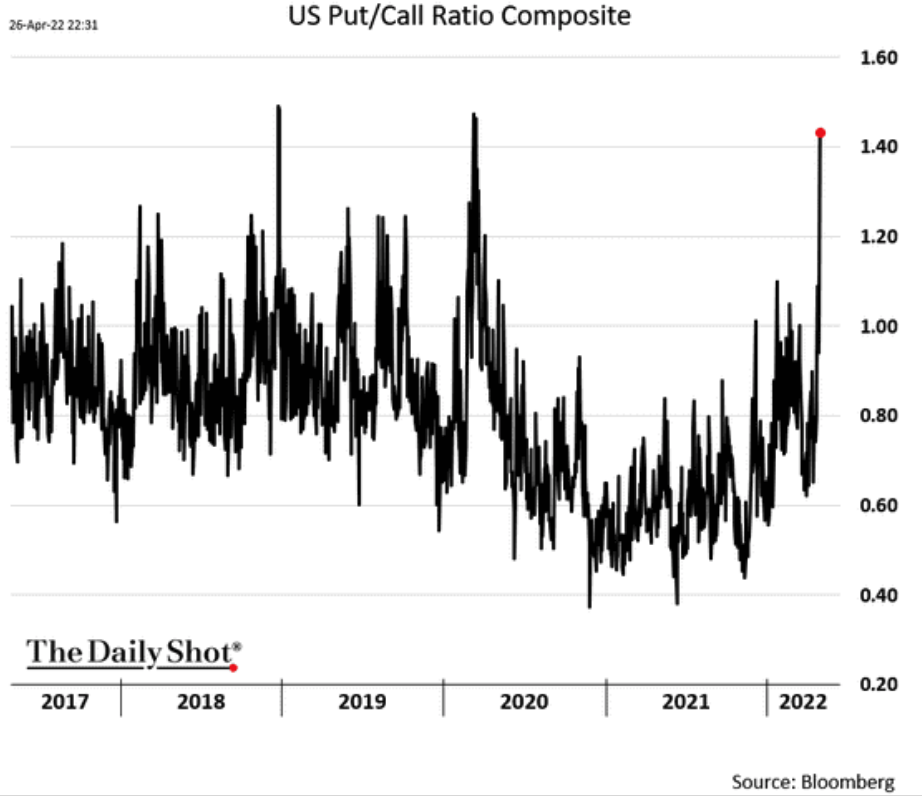

This week, an important stock market indicator spiked higher, sending a clear signal to investors.

This type of spike often happens just before a big rebound. And today I want to explain how this signal works — and why you may want to start building more aggressive positions to get ready for a bounce.

The Put / Call Stock Market Indicator

The stock market indicator we’re looking at today is known as the “put / call ratio.“

It measures the number of put option contracts compared to the number of call option contracts traded in a given period of time.

As a quick refresher, investors buy put contracts to bet on stocks trading lower, and they buy call contracts to bet on stocks trading higher.

This indicator surges higher when investors are buying more put contracts. And that’s exactly what we’re seeing in today’s market.

Given the recent stock market weakness, the fear is understandable.

But remember the famous investment quote from Nathan Rothschild:

“Buy to the sound of cannons and sell to the sound of trumpets.”

In other words, investors should be buying (at low prices) when the rest of the world is panicking. And it makes sense to take profits off the table when everyone else is celebrating!

This Stock Market Indicator Points to a Rebound

Stock market indicators like the put / call ratio aren’t magic. And you should know that they’re not perfect in predicting a market bounce.

But they do tell us some important things about the way investors and traders are positioned.

Many long-term investors buy put contracts to hedge (or insure) their stock holdings. This way, if the market trades lower, they can make a profit on their put contracts which can offset potential stock losses.

If enough investors buy these insurance contracts, fear is taken out of the stock market.

That’s because to insured investors, it doesn’t matter if stocks trade lower. Their insurance policies are in place so these big institutional investors can sit back and watch the drama unfold.

They can also buy new shares of stock at lower prices. And they can do it with confidence because much of their existing portfolio is already protected.

So whenever you see the put / call ratio spike, it tells us that many investors are immune to the fear. And there is less of a risk for widespread panic to keep driving stock prices lower.

Consider Adding Some Bounce Candidates

Hopefully you’ve been building a watch list of stocks you’d like to buy at a discount. That’s always a good idea — but especially so in a stock market correction.

Today’s stock market indicator is flashing a buy signal. And that means you can start nibbling on some of your favorite watch list stocks.

Given the recent stock market action, I wouldn’t jump in with both feet yet. (Remember, these stock market indicators aren’t perfect. The market could continue to trade lower from here.)

But I would put 20% to 30% of your dry powder to work today in anticipation of a stock market bounce.

Today’s turbulent market favors nimble investors who pay closer attention to the day-to-day action.

I’ve got my eye on a number of exciting plays in the travel and leisure industry. I’m watching a handful of profitable large-cap tech stocks. And I still like companies that sell tangible products to individual and corporate customers.

Let’s start “buying to the sound of cannons” so we can profit from a stock market rebound.

Here’s to growing and protecting your wealth!