Are stocks headed for an official bear market?

Investors ended last week on a sour note, pushing stock prices sharply lower and bringing the S&P 500 much closer to official “bear market” territory.

(A bear market is when stocks pull back more than 20%. And as of Friday’s close the S&P 500 is down about 18%.)

Given fears of inflation, the Fed’s interest rate policy, and international risks like China’s zero covid policy and Russia’s invasion of Ukraine — I wouldn’t be surprised to see the S&P 500 enter official bear market territory.

But with that said, it’s not a good time to panic and close all of your investment positions.

Bear markets — and the rebounds that follow — can actually help smart investors grow their wealth!

But you sometimes have to look a little harder for the good investment plays. It’s it’s absolutely necessary to manage your risk.

Let’s take a look at some of the opportunities I’m tracking, and some different trading ideas to help you navigate this bear market environment.

Keeping A Balanced Approach is Critical

One of the biggest mistakes that rookie investors make is to concentrate too much investment capital into one or two big plays.

This works well when the market is trading steadily higher.

But bear markets can be extremely volatile, with some stocks trading sharply higher one day, and then plummeting the next day.

If all of your wealth is in one or two big positions, the turbulence can be extreme! And the sharp swings can make it a lot easier for emotions to creep into your decision making.

I like to divide my investments into a “barbell approach.”

- Most of my money follows my core put-selling income model.

- And smaller piece is invested in my speculative trading program.

The idea here is to spread my investments into different strategies. That way if one strategy is pressured by the bear market, another approach may actually be performing quite well!

For example, my put-selling income model closed Friday down 11.67%. That’s better than the market’s 18% drop. But the down market hurt a few of our trades in this model.

Meanwhile, my speculative trading program closed Friday with a 107% gain year to date. This program can bet on stocks going lower as well as on stocks that I expect to rise. And a few of our bearish plays have generated some nice profits.

Important Note: Past performance does not guarantee future returns. I’m relatively pleased with the performance of both of these models. Especially considering the overall market environment. But there is no guarantee future returns will bear any resemblance to recent results.

Let’s take a look at a few of the positions we’re tracking in today’s market.

My Open Income Positions For This Week

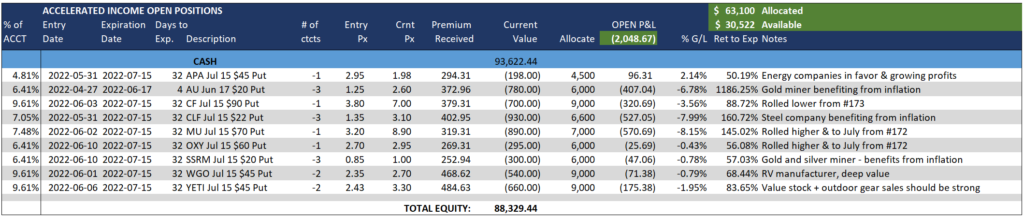

We’ll be kicking off a new week with nine open positions in my put-selling income model:

*I have personal positions in each of these trades.

Energy stocks have been some of the best performing names in the market this year. And our positions in APA Corp. (APA) and Occidental Petroleum (OXY) are both poised to profit from higher oil and natural gas prices.

Even if oil prices pull back a bit, these two stocks could continue to do well. That’s because energy stock prices haven’t kept up with the rise for crude oil. And these companies should continue to profit from elevated oil prices — even if those prices moderate a bit.

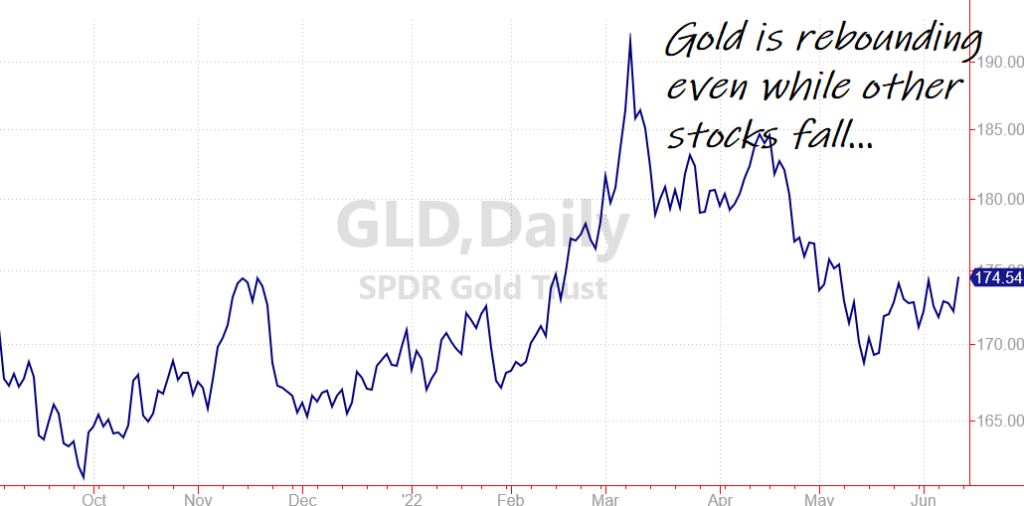

I’m also excited about a recent move higher for precious metal prices. Take a look at the chart for gold below:

Friday’s reading on inflation was higher than expected. And investors are once again turning to precious metals like gold and silver to protect their wealth against inflation.

Positions in Anglogold Ashanti (AU) and SSR Mining (SSRM) should benefit from higher gold and silver prices. And I’ll be looking for new plays to profit from this trend in upcoming weeks.

Finally, note that there is a significant available cash position in this income model. This gives us room to set up new positions if the bear market sends good stocks temporarily lower.

I hope to put some of this cash to work soon!

Bullish and Bearish Speculative Trades

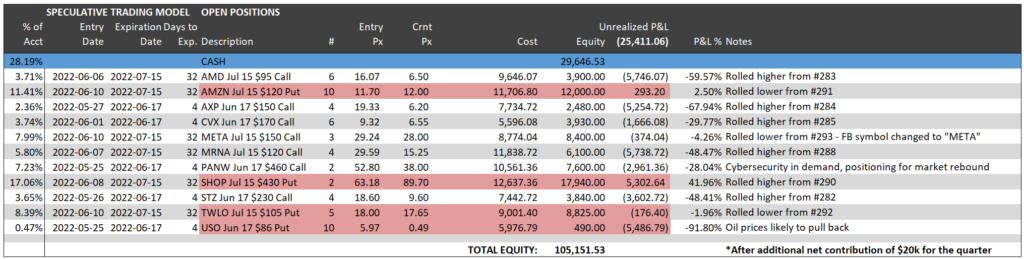

My speculative trading model has a variety of both bullish and bearish positions. (Bearish trades are shaded and profit from stocks trading lower.)

*I have personal positions in each of these trades.

In hindsight, I wish I had more bearish plays in this model heading into Friday’s selloff.

But profits from bearish positions have helped to offset declines from some of my bullish plays. And this model has been able to recognize healthy profits in other positions by closing out some winning plays over the past two weeks.

High valuation growth stocks like Amazon.com (AMZN), Shopify Inc. (SHOP) and Twilio Inc. (TWLO) could have farther to fall. Especially if the S&P 500 enters bear market territory.

Meanwhile, I’m comfortable holding energy plays like Chevron Corp. (CVX) as oil prices trade higher. And semiconductor stocks like Advanced Micro Devices (AMD) have actually been holding up relatively well compared to other tech stocks.

I’m also interested in setting up some new positions in Chinese tech and e-commerce stocks. As China policy starts to shift away from its zero-covid position and leaders start to worry more about China’s domestic economy, these stocks could rebound sharply.

Protect Your Wealth — But Don’t Live in Fear

The broad stock indices are approaching official bear market territory. And it can be tempting to react fearfully — pulling all of your wealth out of the stock market.

But taking a balanced approach and investing in areas of the market that are holding up well can be a better option.

This way, you’re proactively allocating your money into areas that are performing well.

And you won’t be sitting on the sidelines when the market trades higher once again.

If you’re looking for investment or trading ideas in today’s market, I’d love for you to enjoy a trial subscription to my put-selling income model or my speculative trading model.

Both subscriptions come with a 30-day money back guarantee.

And please remember, past performance is no guarantee of future returns.

A bear market doesn’t have to be devastating for your investment account. But it’s a critical time for you to be proactive and tactical with which positions you hold.

Here’s to growing and protecting your wealth!

Zach