Don’t look now, but mortgage rates are actually falling!

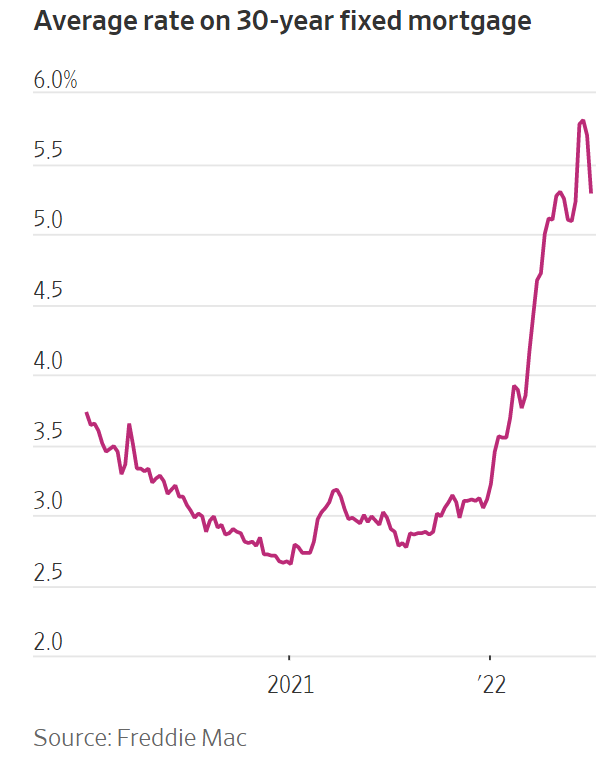

Over the last two weeks, mortgage rates have started to pull back thanks to worries about a potential recession. And while rates are still well above where they were last year, the pullback triggers some exciting changes in other areas of our economy.

Last month, we talked about the selloff for homebuilder stocks.

I explained how there is still a tremendous amount of demand for homes. The Millennial generation includes millions of young adults who are in the prime stage of life for buying a first home. And since these families need somewhere to live, demand should grow even while home prices remain high.

Meanwhile, the supply of homes available simply isn’t large enough to meet this demand.

So nearly every American home under construction is already sold. And homebuilders can charge top dollar — even for homes that haven’t been built yet!

Today, we learned that mortgage rates are pulling back a bit more. It’s great news for buyers — and for homebuilders who continue to work to build as many units as possible.

Falling Mortgage Rates Should Trigger a Rebound

Investors have avoided homebuilder stocks this year for two related reasons.

First, investors expect an aggressive rate hike from the Federal Reserve.

It has led to higher mortgage rates which make homes less affordable for families.

Second, fears of a recession have investors wondering if demand for new homes will fall. Institutional wealth managers are hesitant to make long-term investments in homebuilders in case of demand drops over the next year.

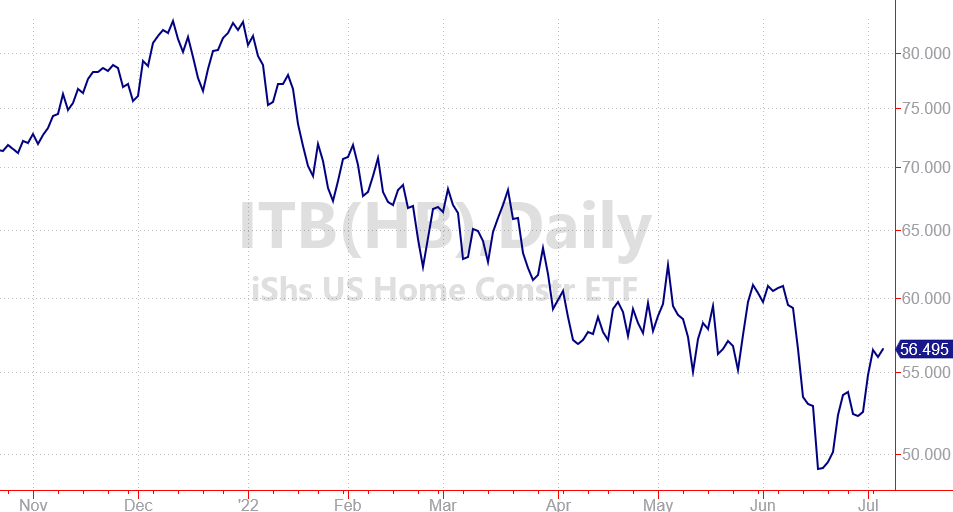

The iShares U.S. Home Construction ETF (ITB) gives us a good picture of how hated this group has become.

But a couple of weeks ago, these homebuilder stocks started to rebound.

Mortgage rates began to pull back, which naturally made the environment “less bad” for homebuilder stocks.

Falling mortgage rates tell us that many believe inflation is starting to come under control. Gasoline prices have declined. And that gives the Fed a bit of room to potentially pause the rate hikes later this year.

Here’s How to Play Falling Mortgage Rates

While mortgage rates probably won’t fall back to where they were last year at this time, we could still see rates pull back below 5%.

As long as rates are pulling back, we should see more strength for homebuilder stocks.

My put-selling income model currently holds a position in D.R. Horton (DHI) — one of the largest American Homebuilders. That pay is working out nicely and I’m looking for new opportunities to add to my DHI position.

[Note: To see new income plays I’m setting up before I place the trades in my own account, sign up for my Accelerated Income Trading Model. You can subscribe for just $99 per month and I offer a 30-day money back guarantee.]

In addition to homebuilder stocks, we could also see strength in retail stocks — fueled by refinancing transactions.

Thanks to home price inflation, many Americans have significant equity in their homes.

A pullback in mortgage rates could trigger another wave of cash-out refinancing. Homeowners may see this as a “last chance” to tap into their equity before rates continue higher again.

As more cash is borrowed, homeowners could resume spending on remodel projects, travel, or other big-ticket items. So I’ll be keeping a close eye on these areas of the market as well.

Make sure you follow along so I can help you find the best areas to grow and protect your wealth!

Zach