There’s one area of the market that investors are particularly sour on right now.

No, I’m not talking about the bear market in speculative tech stocks. That selloff has already been largely played out.

The hated homebuilder stocks may be the most despised area of the market right now thanks to a number of different concerns.

Inflation has pushed home prices sharply higher — to the point where many families simply can’t afford to buy.

Meanwhile, the Fed’s answer to inflation — higher interest rates — has led to mortgage payments that make new homes even less affordable.

It’s no wonder Wall Street has soured on the housing market. And stocks of companies that build new homes have fallen sharply.

But despite these very real challenges for home buyers, it’s still a great environment for companies that build homes.

And if you’re looking for a group of stocks with the potential for big gains in the second half of the year, you absolutely must take a look at homebuilder stocks.

Hated Homebuilder Stocks Offer Deep Value

As the market braces for rising inflation (and interest rates), investors have taken a “shoot first, ask questions later” attitude.

Anything perceived to be challenged by higher rates has been sold. And the route in tech stocks, growth plays, and even long-term treasury bonds has been devastating.

Hopefully you’ve been able to avoid much of this carnage by investing in companies that produce real goods and services and generate real profits.

Homebuilder stocks have been caught up in this selloff. But investors seem to be overlooking some of the positive sides of this industry.

For starters, inflation actually works to the benefit of many homebuilder companies. Because as home prices surge higher, construction companies can sell completed homes at higher prices.

Sure, labor and material costs are higher as well. But for the most part, these costs have been passed on to buyers. That leaves home builders with wide profit margins and strong earnings.

So now, homebuilder stocks are trading at a sharp discount. While profits continue to be very strong.

And thanks to demand for new homes (which still continues to be very strong), these builders should continue to generate strong profits for years to come.

Low stock prices coupled with strong earnings makes the homebuilder industry one of the best deep-value opportunities I’ve seen in a long time!

Homebuilder Rebound: It’s Only a Matter of Time

Homebuilder stocks are trading at a steep discount compared to the earnings these companies generate.

On average, the 47 homebuilder stocks included in the iShares U.S. Home Construction ETF (ITB) trade for less than 9 times earnings.

To put that into perspective, the S&P 500 index currently trades for roughly twice that level.

And this, during a time when investors are moving capital out of growth stocks and into high-quality value plays.

Today, those investors are overlooking home construction stocks because of concerns about interest rates.

But as this group continues to generate strong profits thanks to strong demand for new homes, Wall Street’s fear of this industry should shift.

I expect this entire group to trade higher. Which means buying shares of ITB makes a lot of sense right now.

You could also take a look at individual stocks held by this fund — with a particular eye for stocks that are building homes in high-demand areas like Arizona, Texas and the Southeast U.S.

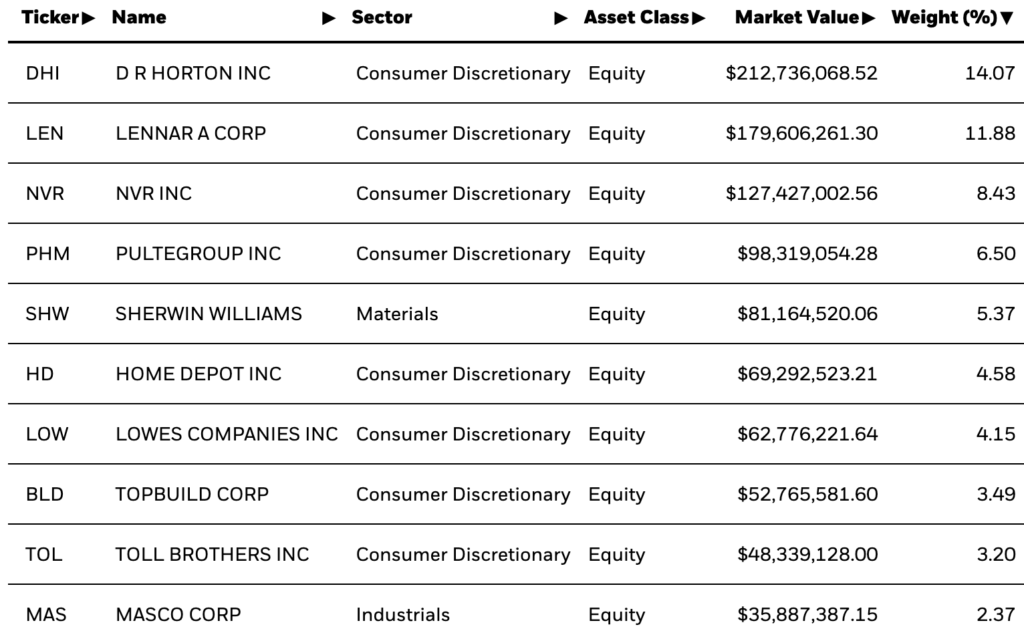

Here’s a list of top holdings for ITB to help you get started.

In today’s market, investors are becoming more selective about which stocks they want to own. Homebuilder stocks should make their way towards the top of that list — giving you profits as the group trades higher.