After a brutal start to the new year, the stock market has finally found support. So how much of a stock market bounce can we expect?

One chart keeps showing up in my research, passed around by traders and investors I deeply respect. And this “trampoline chart” gives me a lot of hope for investors who stick with their plan!

Unfortunately, this chart also shows that many novice and emotional investors are quitting the market at the worst possible time.

Don’t be one of those guys!

Let’s take a look at what this “trampoline chart” is telling us, so you can protect and grow your family’s wealth!

Investors Clear the Deck for a Rebound

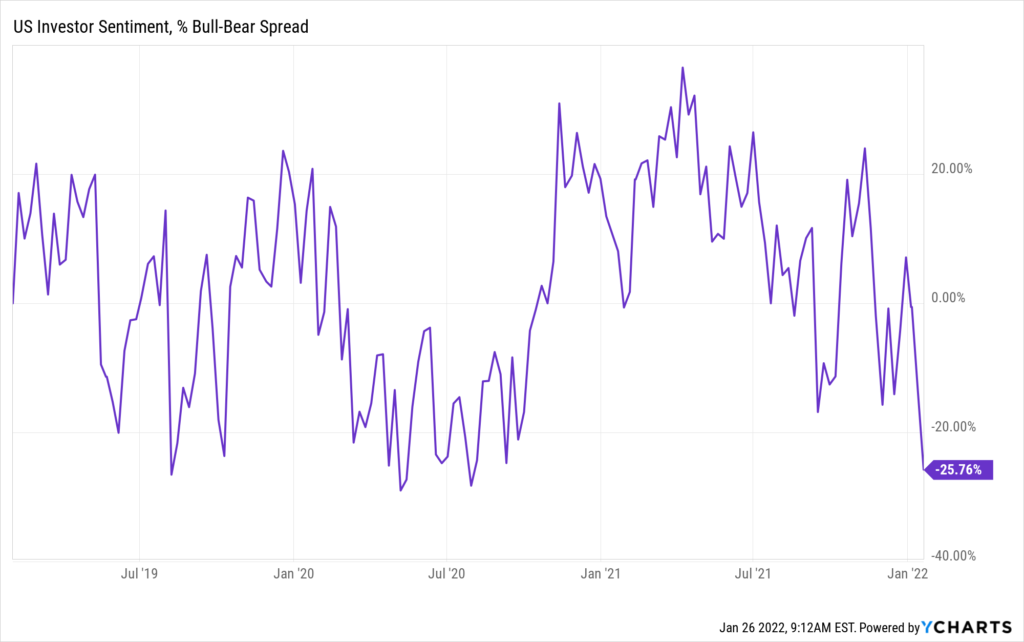

The encouraging chart I’ve seen popping up in my research measures investor sentiment.

In particular this chart shows the difference between investors who consider themselves to be “bullish” versus those who are more “bearish” on the market.

Notice how there are now more “bearish investors than at any time since the early months of the coronavirus crisis.

Ironically, the more cynical and fearful investors become, the greater the chance of a stock market bounce. Just like a trampoline stretches lower just before it springs into action, fearful investors can stretch the market ahead of a rebound.

And when investors become this bearish it can take weeks — if not MONTHS — before that stock market bounce is complete.

This may seem counterintuitive at first.

After all, why would it be a “good thing” when too many investors expect the market to trade lower?

The thing you have to remember is that investors don’t just “feel” emotions like greed and fear. They act on those emotions.

And when the number of fearful investors reaches a critical level, you can bet that these investors have already pulled money out of the market. At the very least, they’ve pulled money out of the most vulnerable areas of the market which matches perfectly with what we’ve seen over the last few weeks.

Now that those investors have already acted on their fears, let’s think about what could happen next…

Why the Stock Market Bounces When Fear is High

If skittish investors have already bailed out of risky positions, where does that leave the current market?

Investors who stepped up and bought shares during over the last few turbulent weeks are naturally the people willing to put emotions aside. So they’re not likely to be scared out of their positions by a frightening headline or short-term downdraft.

After all, if they were likely to sell on negative news, they would have already exited over the last few weeks.

So with strong buyers now holding shares of stock, there’s less selling pressure.

Meanwhile, with more emotional investors largely on the sidelines, there’s a lot of cash available to be put to work!

Once the market stops heading lower, and especially if the market begins to bounce, these emotional sideline investors start getting FOMO. (That’s short for “fear of missing out”)

And thanks to human nature, these investors will steadily start putting their money to work again as the balance of overly bearish investors starts to shift back towards a more normal level.

In other words, a natural reversion to the mean can lead to a sustained rally as investors come back around to investing in the market.

Just don’t expect the same stocks to be the ones leading the charge higher.

Now that speculative growth stocks have fallen out of favor, we’re likely to see this sideline capital come back in to areas of the market that are working right now.

That’s bullish for energy stocks, value plays, profitable blue chip tech companies, and many financial stocks as well.

Don’t let the volatility scare you out of this market. Instead, get ahead of the emotional crowd and be prepared for a potentially high-powered stock market rebound.