There aren’t many things truly “guaranteed” in this world.

Ben Franklin put it best: “Nothing is certain except death and taxes.”

But in the world of investing, there’s one other “sure thing” investors can count on: Treasury bonds.

And while you may think of bonds as “boring” or “slow moving,” that’s really not accurate.

Case in point… A few weeks ago, long-term treasury bonds were down as much as the Nasdaq composite! (And I don’t have to tell you that the Nasdaq has been absolutely pummeled this year.)

That’s not “boring” — and it’s also a tragic development (considering how retirees were told that treasury bonds were “safe” investments).

Almost exactly 1 year ago, I wrote a piece on Paul Tudor Jones. At the time, PTJ warned that rising interest rates would drive bond prices lower. And I’ve spent the last year year pounding the table, warning about the dangers of higher interest rates.

But now that higher interest rates have worked their way into the system, a new set of opportunity is arising. One that can help add stability, income and growth to your investments.

And just like death and taxes, this specific investment is technically guaranteed!

Treasury Bonds Are Finally Attractive

As an investor, it’s important to understand how bonds work.

Basically an issuer — like the United States Treasury — borrows money by selling bonds at a certain price.

The buyer is entitled to regular fixed payments (typically twice a year), and a full repayment (typically $1,000 per bond) when the bond matures.

This is why investors call bonds “fixed income.” — Because you know exactly what you’re going to receive when you buy the bond.

But just because bondholders know what they will receive, doesn’t mean bonds carry zero risk.

Bonds trade in a free market much like stocks.

So while you know exactly what a bond will pay you over time, you don’t necessarily know what you can sell that bond for in today’s market.

When interest rates are higher, bond prices trade lower.

That’s because a NEW bond buyer will expect a discount price when buying. That way the NEW buyer will receive enough income — and a maturity payment — to match the current level of interest rates.

So the long-term payments are fixed, but today’s market price will fluctuate.

And now that interest rates have moved sharply higher in 2022, bond prices are sharply lower. In fact, I think long-term treasury bonds are now very attractive investments!

Buy Low, Sell High…

Just like with any other investment, your goal with treasury bonds should be to buy low (at an attractive price) — and eventually sell high (for a profit).

Treasury bonds come in all different flavors.

Some mature in a year or two, and some in 20 years or more.

Some bonds pay you income twice a year, and some are “zero-coupon”. Meaning they only pay you $1,000 per bond when the issue matures.

Generally speaking, longer-term bonds are more sensitive to interest rates. And “zero coupon” bonds are also more sensitive than bonds that make payments along the way.

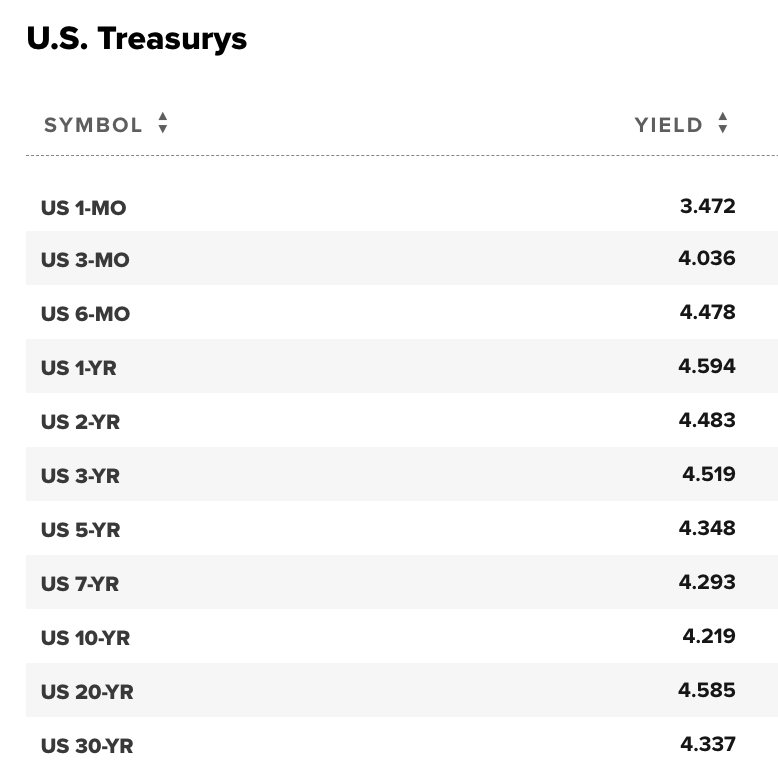

Today, I see an opportunity to buy long-term treasury bonds that yield close to 4.5%. (Below is a quick snapshot of treasury bond yields from CNBC — as of Friday’s close)

If you buy 20-year or 30-year bonds today and interest rates roll lower, the market price for your bonds will naturally rise.

So a purchase today guarantees that you will receive a total return near 4.5% (per year) if you hold the bonds through maturity. And you have a chance of selling the bonds at a much higher price if interest rates roll over!

Two Ways to Invest in Bonds

To profit from a decline in yields (and an increase in bond prices), my first recommendation would be to buy actual bonds issued by the United States Treasury.

While this may be unfamiliar territory for many investors, most brokerages offer bonds on their platform.

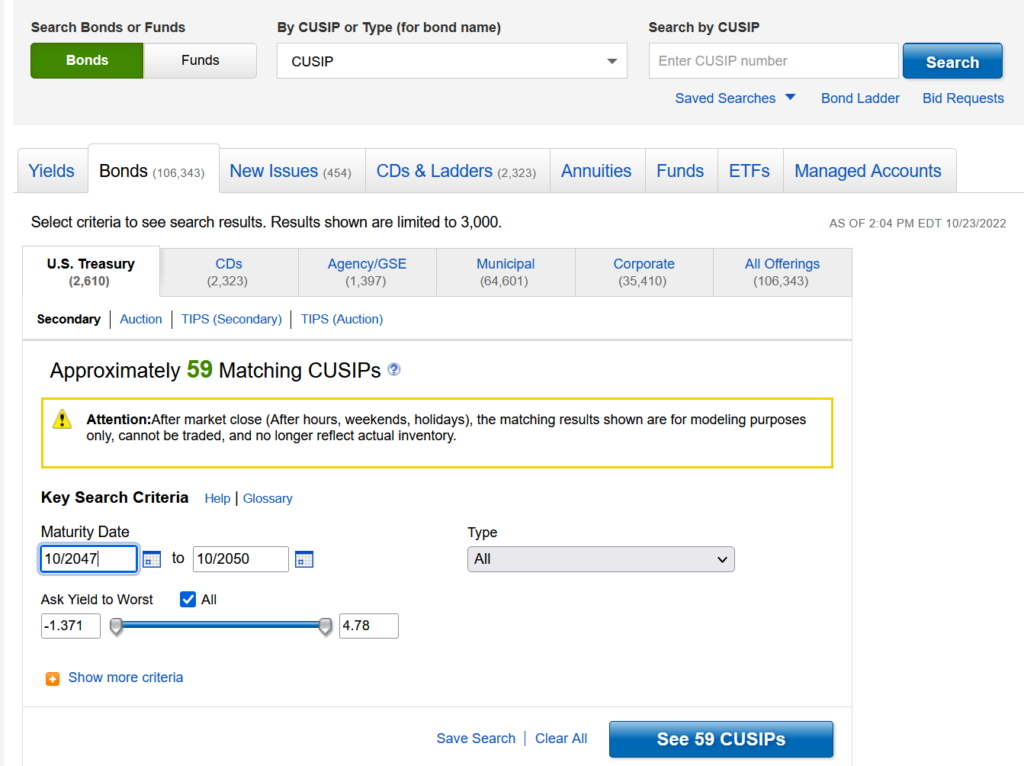

Just look under “fixed income” and then “U.S. Treasury.”

From there, you can select a date range for when you want your bond to mature and see a list of what bonds are available.

Here’s what the Fixed Income screen looks like in my Fidelity account. (Other brokerage platforms will be similar.)

From this screen, you can view all the bonds available, and decide which one to buy. And you may want to invest in a few bonds with different maturity dates. That way, if you hold the bonds long-term, you have more options for when you put the capital back to work.

If you’re not comfortable buying individual bonds, consider the iShares 20+ Year Treasury Bond ETF (TLT).

This fund invests in long-term bonds, but trades just like a stock. So buying shares of TLT will give you exposure to long-term bonds. But you’ll be buying a very liquid fund that is active whenever U.S. stock markets are open.

Prepare for Lower Yields — But Manage Your Risk

Interest rates may be close to topping out.

As the economy enters a recession (which looks very likely), the Fed will eventually be forced to pivot. And that means it’s target interest rate will likely decline.

The same should happen for long-term rates.

Owning long-term treasury bonds is a great way to profit from this shift.

But remember, the Fed is likely to pivot because the overall economy is weakening. So you need to be cautious with your other investments — especially speculative stocks that trade at premium prices.

I’d love for you to stay ahead of this challenging period by creating more income in your account.

So today, I’m encouraging you to take a close look at my Accelerated Income Blueprint. It’s a free report that explains an investment strategy I’ve used for more than two decades now.

During challenging market periods, this strategy can allow you to collect up-front payments from stocks you would like to own — while actually taking less risk than buy-and-hold investing.

This link gives you full access to my blueprint which explains how you can use this method in your own investment account.

Give it a quick read and let me know what you think!

Here’s to growing and protecting your wealth!

Zach