I hope you’ve enjoyed the three-day weekend!

Over the past few days, I spent some time looking through my weekend research — including a number of key charts I track.

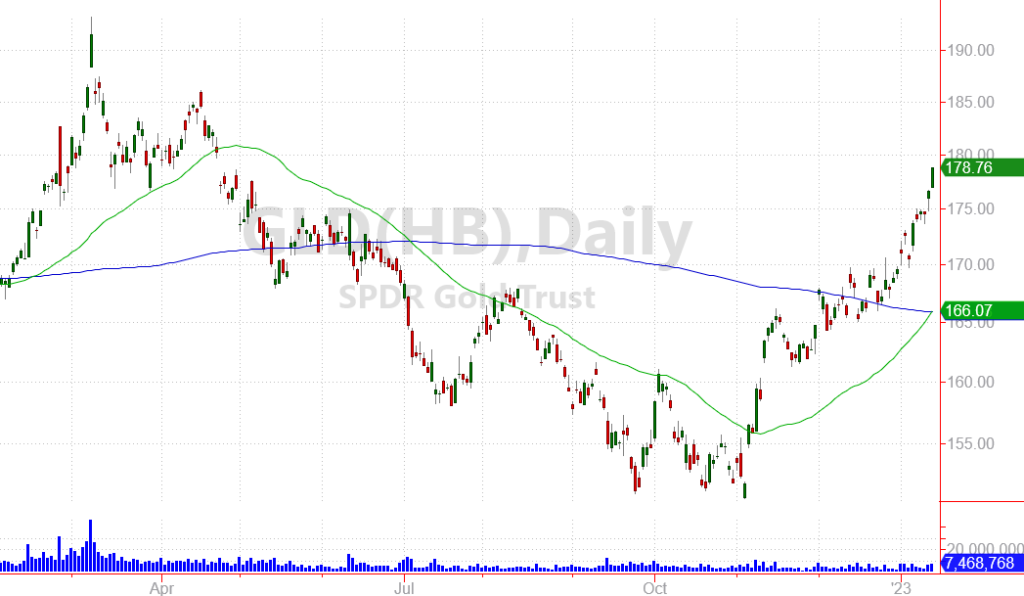

The highlight of my weekend research had to be the gold chart you see below. The yellow metal is surging higher and playing “catch up” to the inflation we’ve been facing for over a year now.

With gold making such a strong run to kick off the year, it’s important to understand how you can invest in gold to make the most of this opportunity.

Here are three of the best ways you can profit from a rise in gold prices.

Play #1: Physical Gold

Many people like to own physical gold.

The advantage here is that you know exactly where your gold is. And you don’t have to worry about an intermediary going bankrupt or misappropriating your assets.

Some believe this is the best way to preserve your wealth if the broad financial system breaks down.

Personally, if we get to that point I’d much rather have a healthy storage of bullets and bottled water. (To hunt, protect my family, and meet our basic needs.) But physical gold could certainly have some utility in that situation.

Especially if you own smaller denominations like gold coins.

One trustworthy source for buying physical gold is Hard Assets Alliance.

The company can ship you gold via certified (and insured) mail. Or they can hold gold for you in one of their many vaults around the world. I don’t personally have an arrangement with Hard Asset Alliance, but the publishing company I write for — Paradigm Press — has an affiliate relationship with the company.

I’m sharing that just to make sure I disclose any potential conflict of interest.

Owning physical gold may be helpful for a long-term position. But it’s certainly not a very efficient way to invest in gold.

Which brings me to the second gold investment option.

Play #2: “Financial Gold”

If you have a traditional brokerage account, you can easily invest in what I consider “financial gold.”

The SPDR Gold Trust (GLD) is a fund that closely tracks the market price for gold.

This fund trades just like a stock. So any time the market is open, you can buy or sell shares of GLD. If the price of gold rises by 10%, your shares of GLD should do the same.

While GLD isn’t the only fund that closely tracks the price of gold, it’s the most popular ETF in this area. Which means there is plenty of trading volume each day, making it easy to buy or sell a large amount without moving the market price for GLD.

By the way, if you’re more interested in silver as a precious metal, you may want to invest in the iShares Silver Trust (SLV). This fund operates the same way as GLD, except it tracks the market price for silver.

If you want to take a more aggressive position, consider buying shares of the Direxion Daily Gold Miners 3X (NUGT).

As the name implies, this fund gives you three times the price movement for gold. So if gold is up 3% in a single day, your NUGT position should increase by 9%.

Please be careful with funds like this. These leveraged investments can be great for short-term plays. But since they also lose 3X the pullback when gold trades lower, leveraged funds carry a significant amount of risk.

For my own family’s wealth, I prefer using GLD or trading options on this ETF. (I currently have a bullish options play on GLD in my Speculative Trading Program. More information on the program here.)

Now, let’s look at the third gold investment you should consider.

Play #3: Gold Stocks

A third way to profit from higher gold prices is by owning gold mining stocks.

Many miners will benefit tremendously from a sharply higher gold price. After all, these miners can sell gold at a higher price (per ounce), locking in wider profit margins.

Keep in mind, miners have significant expenses. So while inflation has been driving the price of gold higher, it also drives costs like diesel fuel, equipment maintenance, labor and other expense items.

Still, while higher expenses can reduce profit margins, most miners have vast underground resources. And these resources are valued based on current — and expected — prices for gold. So the higher gold trades, the more value these underground resources carry.

The VanEck Vectors Gold Miners ETF (GDX) is a fund that invests in a basket of blue-chip gold mining companies. This fund is a great way to gain broad exposure to profitable mining stocks that are currently producing gold.

Another more speculative option is the VanEck Vectors Junior Gold Miners ETF (GDXJ).

This fund invests in smaller mining companies. Many of these miners are still building out their production capacity. Some still need capital to develop their mines. And many are not profitable based on the current price of gold.

But as gold prices rise, junior miners often gain more on a percentage basis.

That’s because once gold moves above a certain price these miners can go from money-losing enterprises to profitable entities. Higher gold prices can also make junior miners more attractive as takeover candidates.

My Accelerated Income Model currently holds an income play on GDXJ. This model uses the same put-selling income strategy that I talked about yesterday.

You can find more information on the Accelerated Income Model here.

Gold has already started trading sharply higher this year. I recommend using one of these three options to tap into this opportunity for your own family!

Here’s to growing and protecting your wealth,

Zach