After 3 consecutive quarters of losses, many investors are discouraged. But there are plenty of opportunities heading into the fourth quarter.

inflation

Jerome Powell Has a Reckless Driving Problem

Jerome Powell’s reckless driving is sending our economy veering off the road. Here’s how to protect your savings.

Here’s What I’m Watching This Week

After a sharp bear market rally, investors are looking forward to this week’s CPI print. Here are some stocks I’m watching this week.

The Fed Pivot is Real — But Not What You Think

The Fed Pivot was based on hopes the Fed would change direction. Instead the Fed changed it’s definition of inflation

Consumers are Spending on Fun – Invest With Them!

With affluent consumers spending on fun activities, travel and entertainment stocks are on the rise. Here are some investment areas to focus on.

What the Apple News Tells Us About Inflation

Apple’s bad news this week is actually GOOD news for investors. Here’s more evidence that inflation is falling and could trigger a bear market rally.

These Stocks are Holding Up in Today’s Market

Despite the bear market, some stocks are holding up well. Here’s what I’m watching this week.

Inflation is Hot, But Not As Bad as it Looks

Today’s CPI report told us inflation is hot. But the evidence is mixed. Here’s how I’m investing to protect my family from inflation.

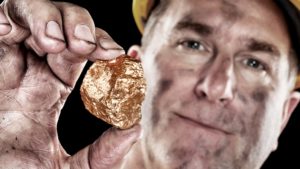

Time for Gold to Rally!

The gold rally has been held back by two important factors. But now that these two challenges are going away, gold could surge!

What I’m Watching as an Official Bear Market Looms

Stocks are just a couple percentage points away from official bear market territory. Here’s how I’m positioned heading into next week.